Assets, one of the most important elements in accounting, have many different characteristics that allow them to be classified. This classification is according to their types, and among them are the intangible assets that are postulated by IAS 38.

Thus, for accounting in its totality, whether national or international, assets are one of the indispensable elements. These elements are characterized by being the assets and rights of a company that generate cash. Therefore, they will always be on the positive side of the Balance Sheet.

The Balance Sheet is the accounting and financial report that presents the company’s financial situation whenever a period comes to an end. The report will always determine the values of assets, liabilities and equity. In order to list all the company’s rights, assets, obligations, resources, and investments.

Through this report, managers are able to get a crystal-clear and broad view of their business values. With this data, it is possible to verify and identify financial health. This way, the company can know whether it is reaching its goal of generating profits, staying in the market, investing, or retaining expenses.

It is very important that a company recognizes and knows about its assets (goods and rights), liabilities (obligations and debts), and net worth (the difference between the value of assets and liabilities). So that managers know where their company stands in relation to its values, activities, and investments.

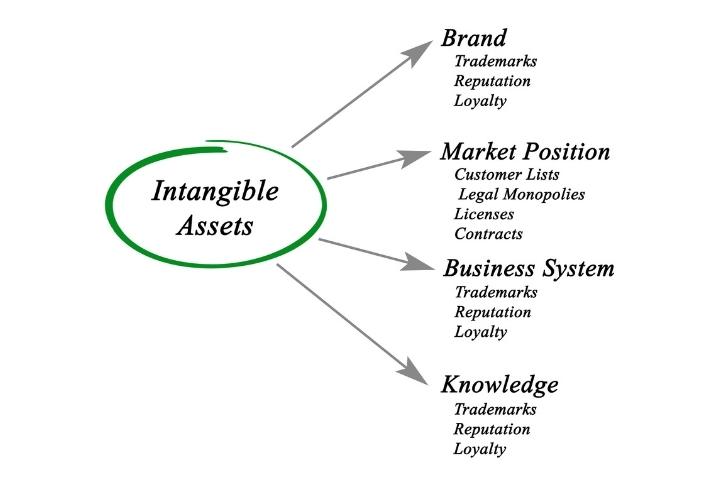

Therefore, when a company owns an asset, it expects it to generate future benefits for the business economy. However, among the various types of assets with their different characteristics, there are those that lack physical substance but are identifiable. And these are the intangible assets as defined by IAS 38.

Table of Contents

ToggleIAS 38 summary

In 2001, more specifically in April, the International Accounting Standards Board, IASB, adopted IAS 38 – Intangible Assets. This was originally issued by the International Accounting Standards Committee in September 1998.

Assets are a group of goods and rights that generate value for a company. Therefore, there are numerous types of assets, and among them are intangible assets. Since these assets have special characteristics, there must be criteria for their recognition, measurement, and disclosure.

To achieve this there is the international accounting standard IAS 38. After all, every company loses resources when obtaining, developing, maintaining, or improving its intangible assets.

Thus, this accounting standard shows that intangible assets, those that do not have materiality, develop internally in a company. Another way to get intangible assets is to acquire them separately. Or also in a business combination.

Therefore, the aim of IAS 38 is to prescribe the accounting procedure for these types of assets that are not specifically dealt with in another standard. IAS requires a company to recognize an intangible asset only if certain criteria are met.

Which CPC corresponds to IAS 38?

To converge and unify Brazilian accounting standards with international accounting standards, the Accounting Pronouncements Committee was created. This was necessary, because with the globalization event and the opening of markets around the world, many companies have established themselves in countries other than those of their origin.

With this, both the host country and the international company need a unified language. To make this unification possible, the Accounting Pronouncements Committee adapted international standards to the Brazilian accounting reality.

Among the IAS or IFRS that were adapted by CPC is IAS 38 – Intangible Assets. Thus, the standard corresponding to this IAS is CPC 04 – Intangible Assets.

CPC 04 – Intangible Assets

Approved in 2010, CPC 04, which deals with intangible assets, is responsible for presenting the pertinent information regarding the accounting for this type of asset. That is, there are other pronouncements that postulate on other types of assets, but not on intangibles.

With this, CPC 04 presents some specific determinations for an asset to be intangible. By recognizing it, the company can account for it and measure its book value.

IAS 38 and intangible assets

IAS 38 is the international accounting standard responsible for establishing the criteria for recognizing and measuring intangible assets. In addition to demanding disclosures about them.

According to IAS 38, an intangible asset is an asset that has no physical substance as well as no monetary identification. In addition, it is kept for use in production, supply of goods or services, to be leased to others, or for administrative purposes.

Thus, this asset is a possession that a company controls as a result of events that have occurred. And from which it is expected that they will generate, for the company, many economic benefits at a future time.

To identify an intangible asset, it needs to be separable or arise from contractual, legal, or other types of rights. Also, a company can sell, transfer or license these separable assets.

Thus, the three critical characteristics of an intangible asset are:

- Identifiability;

- Control (possibility of getting benefits from the asset);

- Economic advantages in the future (such as revenues or cost savings in the future).

How to recognize an intangible asset?

IAS 38, in addition to the various information about intangible assets, postulates about a company’s requirement to recognize this type of asset. That is, she can recognize it, whether purchased or self-created, only if:

- It is likely that it will assign economic privileges to the company in the future;

- You can measure asset spending reliably.

Thus, these requirements only apply if a company acquires an intangible asset externally or generates it internally. IAS 38 also includes additional recognition criteria for those assets that the company generates internally. They are:

- The possibility of culminating in future economic benefits must be based on reasonable and favorable assumptions about conditions that will exist during the asset’s life;

- The probability recognition method is always considered satisfied for intangible assets that are acquired separately. Or when businesses combine.

Therefore, if the recognition methods are not met, IAS 38 requires that the cost of such an asset is recognized as an expense. And that’s when it incurs.

Is there a possibility of an intangible asset being inside a tangible asset?

Under IAS 38, an intangible asset, one that has no physical substance, can be contained within a tangible asset, one that can be touched, seen, or felt.

An example is when a company uses computer software. It is an intangible asset that can be inside a compact disc. Specifically in those cases where the assets have both tangible and intangible characteristics, companies need to use IAS 16 Property, Plant and Equipment.

How to identify an intangible asset?

A company and its managers will be able to identify an intangible asset when it:

- It has the characteristic of being separable. That is, there is the possibility for the company to separate, sell, transfer, license, lease, or exchange this asset. Either individually or with a related contract;

- It arises from contractual or other rights, regardless of whether these rights are transferable or separable from the company or from other rights and obligations.

How to acquire an intangible asset?

Another aspect that IAS 38 informs about is the way that a company can acquire an intangible asset. In this way, it is possible to acquire them:

- By separate purchase;

- As part of a business they combine;

- For a government grant;

- By exchanging assets;

- By self-creation, that is, internal generation.

Classification of intangible assets based on their useful life

IAS 38 also provides information about the classification of assets according to their useful life. Thus, there are two types of classification:

- Indefinite life: There is no presumed limit to the definite moment when the asset will have to produce net cash inflows for the company;

- Finite life: refers to a limited period of economic benefits for the company.

Examples of intangible assets

Among the numerous examples of intangible assets, the main ones that companies use the most are:

- Patented technology;

- Computer software;

- Databases;

- Scientific Knowledge;

- Market ownership;

- Market knowledge;

- Internet domains, video domains, and any other audiovisual material;

- Intellectual capital;

- Licenses;

- Trademarks;

- Patents;

- Rights, such as marketing and mortgage maintenance;

- Licensing, franchise and royalty agreements;

- Relationships between customers and suppliers.

Is goodwill an intangible asset?

Goodwill that a company acquires in a business combination is accounted for under IFRS 3. Therefore, it is outside the scope of IAS 38.

Internally generated goodwill is within the scope of IAS 38, but the standard does not recognize it as an asset. After all, it is not a resource that there is any way to identify. This means that goodwill is not separable, nor does it have rights, either contractual or legal, that the company controls. Thus, they do not have a confidence level to be evaluated for their cost.

To which intangible assets does IAS 38 not apply?

IAS 38 applies to all intangible assets, except a:

- Financial assets(IAS 32);

- Exploration and evaluation assets (IFRS 6);

- Expenditures for the development and withdrawal of minerals, oil, natural gas and similar goods;

- Intangible assets arising from insurance contracts issued by insurance companies;

- Intangible assets covered by another IFRS, such as intangibles held for sale (IFRS 5);

- Deferred tax assets (IAS 12);

- Lease assets and assets arising from lease operations (IAS 17);

- Assets arising from employee benefits (IAS 19);

- Goodwill that the company acquired in a business combination(IFRS 3).

Expenses with intangible assets

Any expenditure that a company has on an intangible asset that belongs to it is called an expense. However, this expenditure is not an expense if there is a guarantee that it will give economic benefits in the future. Besides the fact that its cost can be calculated with certainty.

With this, IAS 38 shows that a company’s expenditure in setting up an intangible asset internally is often difficult to distinguish. And that’s in connection with the cost of maintaining or improving the company’s operations or cash flow. And that is why some things like internal brands and customer lists are not intangible assets.

Generation costs for other internally generated intangible assets, on the other hand, are found when the assets are in a research or development stage. For example, research expenditures are entered as expenses. Development expenditures that follow the specified definitions are cost of an intangible asset.

But there are some types of expenses that cannot be present in intangible assets:

- Overhead and administration costs;

- Insertion of a new product or service;

- The company enters a new location or a new market sector.

What is the cost of this type of asset?

The cost of an intangible asset that a company acquires is the purchase price plus its purchase taxes or import duties. However, the amount of your taxes needs to abstract the discounts and rebates.

Measurement of intangible assets under IAS 38

Under IAS 38, a company measures this type of asset initially at cost. After initial identification, she usually measures an intangible asset at its cost with the subtraction of the amortization that has accumulated.

Thus, it is the company’s option to choose to calculate its asset at fair value. But this occurs in rare cases where fair value can be determined by reference to an active market.

For both types of asset life, this asset with a defined useful life is amortized and tested for impairment. On the other hand, there is no amortization of an intangible asset with an indefinite useful life. But the company tests it annually for impairment.

There are also cases of disposal of intangible assets. When an intangible asset is disposed of, the gain or loss on the disposal is included in the result.

Control of intangible assets

Many managers have doubts about the control of these assets. Therefore, IAS 38 states that a company has control over an asset if the asset can, in the future, provide economic benefits.

A company’s ability to take action to promote economic advantage would normally result from legal rights that are enforceable in a court of law. However, there are cases where there is a lapse of laws, and in these situations it is more difficult to demonstrate control

Even with these situations, IAS 38 posits that the legal enforceability of a right is not fundamental to the control of an intangible asset. Because the company may be able to manage the expected future economic advantages in some other way.

For example, technical and market knowledge make it possible for an intangible asset to culminate in future economic benefits.

Future economic benefits

These benefits, which are derived from an intangible asset, may include:

- Revenue from the sale of products or services;

- Cost savings or other advantages that result from the use of the asset by the entity.

An example of a future economic benefit is the use of intellectual property when it becomes part of a production process. After all, such use may decrease future production rather than increase future revenues.

How to find out if an intangible asset will bring future economic benefits?

There is no certainty regarding the generation of positive corporate cash values from intangible assets.

Thus, a company must assess the probability of expected future economic benefits when using using reasonable assumptions. These should be based on and represent management’s best estimate of the set of economic conditions that exist over the useful life of the asset.

However, using judgment to assess the degree of certainty associated with the flow of future economic benefits that are attributable to the use of the asset is not an easy task. Even this involves and is based on the evidence available at the time of initial recognition, which enables greater reliability.

Therefore, to perform the recognition and measurement of intangible assets, in addition to acquiring pertinent and relevant information on this subject, be sure to contact a specialized service.

The CPCON group has been operating in Brazil and in the American continent for more than a decade. And all this because of its qualified professionals who value and provide excellent service. Be sure to contact our accounting services, whether for intangible asset management or any other type of business management. CPCON is available to help any company achieve its goal of making a profit and establishing itself in the market. Just like the many companies that have already relied on this help!